2024 CONVENTION INFORMATION

It's Better in a Union

71% of Americans support unions, the highest level in nearly 60 years. And our future is bright: 88% of people younger than 30 support unions, too.

Featured News

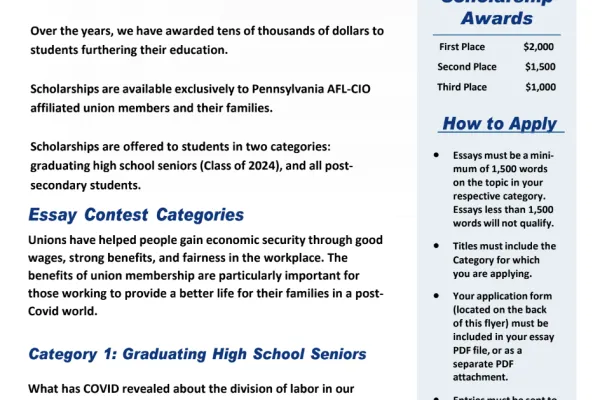

2024 Scholarship Essay Contest

A New Way to File Taxes

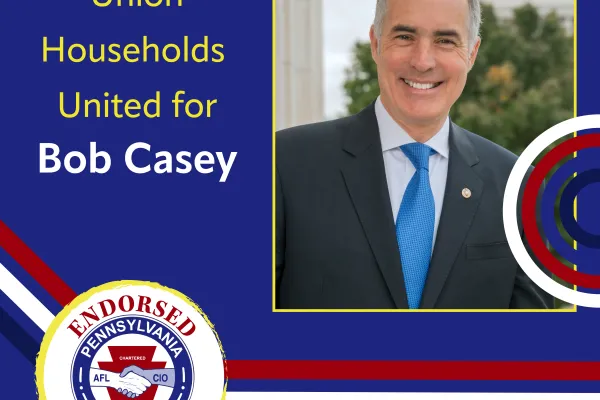

PA AFL-CIO Endorses Bob Casey for U.S. Senate

News

PA AFL-CIO Endorses Bob Casey for U.S. Senate

PA AFL-CIO Endorses Bob Casey for U.S. Senate

Read More > PA AFL-CIO Endorses Bob Casey for U.S. Senate

Buy Union for the Holidays!

Record a Video

Tell us why the PRO Act is important to you and how it will help all working people.

Get Involved

In The News

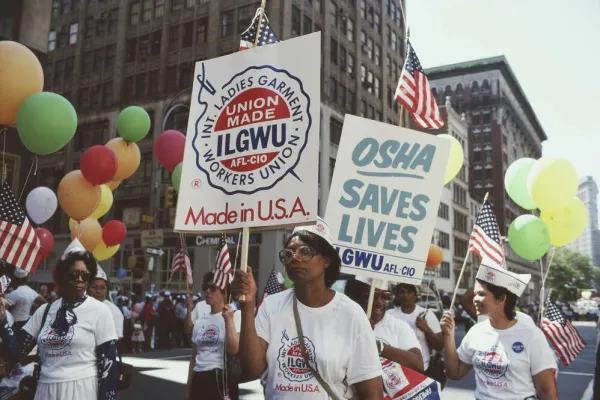

This Is the Story of How Workers Win

Protecting Workers’ Interests in the Tech Revolution

AFL-CIO Values Statement

Find a strike near you

Labor for Biden Event

AFL-CIO News Feed

-

Win A Better Future: In the States Roundup

-

Service & Solidarity Spotlight: GM Aramark Workers Win Major Gains

-

Service & Solidarity Spotlight: Minnesota Grocery Workers Reach Tentative Contract Agreement

-

The Fight Goes On: The Working People Weekly List

-

Service & Solidarity Spotlight: Volkswagen Workers Become First Southern Autoworkers to Win Their Union

-

Service & Solidarity Spotlight: Workers at Portland Hilton Secure New Contract After Two Years of Bargaining

-

SOLIDARITY ALERT: Sesame Workshop writers

-

Worker Wins: A New Way of Doing Business

-

Service & Solidarity Spotlight: IAM Hails Passage of Library Worker Rights Legislation

-

Fighting for Our Rights: What Working People Are Doing This Week